Forex Trading

Scanning for Consolidation and Breakouts

Contents:

In the case of a downside https://trading-market.org/, often called a breakdown, if it fails the price will rally back above the support level it broke below. A breakout refers to when the price of an asset moves above a resistance area, or moves below a support area. Breakouts indicate the potential for the price to start trending in the breakout direction.

- For short term trading, David employs a data-based approach to trade equities and derivatives.

- Traders and active investors use breakouts to identify trends in their early stages.

- It does not need to be an all-time high, it can be a 52-week high or any other high point that looks significant on the chart.

- This is a strong indicator that confirms a breakout into an uptrend.

- Bollinger Bands is one of the best indicators for breakout trading.

Another signal of a good breakout is if the breakout area holds on re-tests. If the price falls right back through the resistance level, this is not a good sign and traders could look to exit the trade. If there are no positive signals, a trend reversal in the opposite direction is more likely.

In our previous examples, we were scanning for consolidation that was still going on at the time of the scan, so our uptrend and consolidation clauses were looking at today’s values. Now that we are adding a breakout to the scan, we need to make some adjustments. Since we want to look for stocks that were consolidating yesterday and are breaking out today, we need to change our uptrend and consolidation clauses to look at yesterday’s data.

This indicates that motivated buyers are becoming impatient and slowly increasing their bid breakout technical analysiss causing the pullbacks to progressively become shallower. Eventually, there are no more pullbacks as buyers swarm in causing prices to breakout through resistance. This pattern is also identified as an ascending triangle breakout.

Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week. MarketRank evaluates a company based on community opinion, dividend strength, institutional and insider ownership, earnings and valuation, and analysts forecasts. A stop-loss order is generally placed at the lower Bollinger Band after entry. As the price increases, it is possible to move the stop loss up along with the lower Bollinger Band as well. With an entry near $105, this would have kept the trader in until $150, when the price touched the lower band.

Bankrate logo

We input our backtest details, run the backtest, and view the stocks that were selected by the backtester. However, I think it is useful to know the actual signals used by the backtester and how the overall trading signals were calculated based on the z-score. I hope this new signals table will help you understand why the backtester selected the respective stocks in your current portfolio and help you rank these stocks based on their trading signals. If you would like to see this new feature in action, I invite you to create a fundamentals backtest using the magic formula. Breakouts in the stock market can provide the opportunity to trade on large price movements once the price breaks above the resistance level or below the support level.

Tech View: Nifty charts indicate more pain ahead. What should traders do on Tuesday – The Economic Times

Tech View: Nifty charts indicate more pain ahead. What should traders do on Tuesday.

Posted: Mon, 17 Apr 2023 11:49:00 GMT [source]

There are a couple different ways you can use the Breakouts Module to your advantage. Perhaps the best option is to look for stocks that are both crossing above or below a simple moving average while also trading on higher than average volume. Simply scan on these two parameters, then sort the results by ticker symbol to spot symbols that are breaking out on both price and volume. When a stock makes a major move up or down following a period of consolidation, it’s called a breakout.

How much does trading cost?

However, a new high alone doesn’t confirm that a breakout is happening or that it’s likely to succeed. So, it’s important to also limit your search to stocks that are trading on strong volume. A bullish breakout occurs when the upper band is breached, whereas a bearish breakout happens when the lower band is breached.

- Hi everyone, I am very excited to share a new feature which allows you to view the signals generated by your trading strategy in your backtest results.

- This allows you to practise your breakout strategy risk-free.

- Like in any other market, stock prices are influenced by forces of demand and supply.

- Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

- However, combining these signals together is not as simple as adding them together.

- But, in that case, the stock would also lose its momentum and would no longer be captured by this scan.

Low float stocks are a type of stock with a limited number of shares available for trading, which tends to cause… Keep in mind that you can expand the timeframes of the scan parameters to look for stocks experiencing months-long periods of consolidation. For example, it’s possible to compare the 10-day low to the 52-week low. Penny stocks tend to have big percentage moves, even though they do not move much in the way of price. For example, a penny stock may trade between $0.04 and $0.05 for a long period of time. Although it is only an increase of a cent, this also represents a 25% leap in value.

Week High Breakouts

QUICK CHARTSQuickly scan through 8 month and 1 year stock charts on up to 560 saved stocks, market indexes and sectors. Tradable stock breakout, T1 and T2 target, along with stop limit and profit to loss ratio. Use new technical analysis to learn when to place a trade and anticipate tops, bottoms, rallies, pullbacks and breakouts before they occur. If you are interested in breakout penny stocks, use top penny stocks.

That followed a 16.4% surge on Tuesday, which bucked the broader stock market’s worst day of 2023, even though AMC didn’t release any news. Make precise swing trades off support areas or daytrade with precise breakout levels. For day traders, the main charts to use are intraday charts. Some day traders use daily charts to filter out stocks that they don’t like. Even if a stock appears strong, remember that everything is relative. To evaluate a stock, it’s important to compare it to its sector or peers and ensure it is strong compared with other alternatives.

Breakout Stocks For Swing Trade

Not everyone cares about the same support and resistance levels. An increase in volume on the breakout shows that the level is important. Lack of volume shows the level is not important or that the big traders aren’t ready to participate yet. To identify breakout stocks, first you’ll need to find a market with a defined area of support or resistance.

Dexcom Stock Nears Breakout, Propelled By Medicare Decision … – Investor’s Business Daily

Dexcom Stock Nears Breakout, Propelled By Medicare Decision ….

Posted: Mon, 17 Apr 2023 20:53:00 GMT [source]

Other reasons can be an unusual call or put option volume in comparison to the stock’s normal volume or heavy insider buying or selling. Understanding why a stock is breaking out can help investors to decide if the breakout is likely to have momentum. Read more in-depth information about essential stock chart patterns here. Resistance refers to a level that the price action of an asset has difficulty rising above over a specific period of time. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

These are just some of the ways you can profit from breakout stocks that are set to break past their resistance lines. A breakout in stocks occurs when the price of a stock breaks above its resistance level or breaks below its support level. After a breakout happens, prices tend to continue moving undeterred with strong momentum. It’s up to you to keep an eye on momentum stocks that are consolidating for a move higher. A true breakout should close above the previous high set by the trend and should be accompanied by above-average trading volume. If the consolidation goes on for too long, the chances of a step higher diminish.

Because of their optimism in the market, some of them whom I met are spending through their future income. What it means is that these are people with excessive debts on their spending. The fastest way to fail is to live a lavish lifestyle before you can even afford it. This might sound very basic and I thought it was uncommon until I met many graduates who were living from paycheck to paycheck.

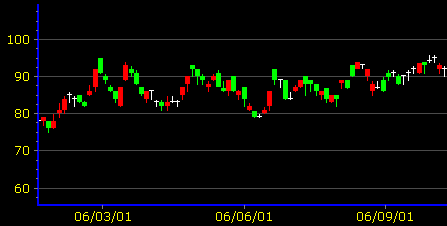

Breakout Charts

A close Friday above that line would suggest a breakout has occurred. Free real time charts with a 5 min, 15 min, 30 min and 60 min intraday to 10 day daily timeframe. To get intraday penny stocks update (every 5-10 minutes), please signup for a free account. We’ve seen breakouts with low absolute volumes or low relative volumes, retrace as quickly as they started.

The higher the standard deviation , the greater the magnitude of the breakout. Being able to ride a breakout is one of the holy grails of trading. The offers that appear on this site are from companies that compensate us.

Want to test out breakout trading before you risk any capital? Open an IG demo to go long and short on our full range of markets with £10,000 virtual funds. The price patterns on the chart offered an indication of the bear run to come.

The indicator does not provide any price breakout directional cues. Still, the return of high volatility in the market is denoted by the divergence of the upper and lower bands of the indicator. When the price is making large movements, the bands will be wide apart.

Using technical indicators instead of multiplication and min/max functions keeps the math to a minimum and can make your consolidation clauses much simpler to follow. In the following example, prices are flat when Aroon Up and Down are below 50, Plus/Minus DI are below 30 and the Slope is near zero. Using min/max functions improves your consolidation scans by accounting for any fluctuations that may have happened during the time period. The second clause ensures that the lowest price over the last 20 days is still higher than the bottom of our range (3% below today’s price).

The first place to go looking for breakouts is the aptly named Scanz Breakouts Module. This is a great tool for finding potential breakouts in progress, allowing you to open a position early on in a stock’s movement. Exit towards market close –When exiting a losing trade, it is wise to do so towards market close. This is because, during the market opening, it might be difficult to ascertain that prevailing prices will hold during the active trading hours. But towards the market close, the prices probably represent the consensus of market participants.

Day trading guide for today: 6 stocks to buy or sell on Tuesday — 18th April Mint – Mint

Day trading guide for today: 6 stocks to buy or sell on Tuesday — 18th April Mint.

Posted: Tue, 18 Apr 2023 01:25:08 GMT [source]

Breakouts then occur when there is a change in the supply and demand of a stock. For instance, a stock will break a resistance level when there are more buyers than sellers at that particular time, whereas a support level will be broken when sellers outweigh buyers. Like in any other market, stock prices are influenced by forces of demand and supply.