Bookkeeping

Quicken vs QuickBooks: Pricing & Differences

Contents:

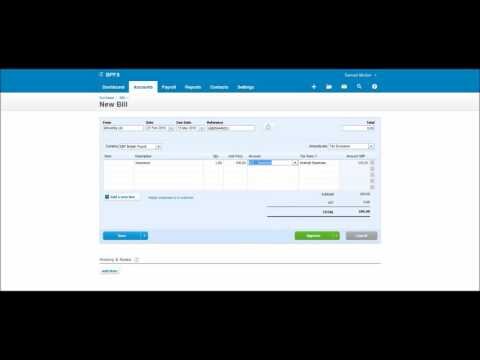

Quicken users said that they appreciate that the platform is inexpensive and an easy way to track personal expenses. The software’s biggest drawback is its inability to perform basic bookkeeping tasks such as invoicing clients. While setting up QuickBooks, you can connect your bank as well as credit card accounts to the software.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

With the Smarter plan ($15 a month) or, the more advanced plan ($35 a month), you may update your firm and adjust your business accounting needs. In addition, premium memberships come with extras like timers, unlimited users, and block books, among other things. In addition to time tracking, Harvest also offers online invoicing as an add-on as a QuickBooks alternative.

Tips for Using QuickBooks for Your Personal Finance

A Windows dialog may appear that asks whether you would like to Save or Open the file, select Open. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us. By providing your mobile number you are consenting to receive a text message.

This should include checking and savings accounts, loans, lines of credit, payroll and credit card accounts. The main difference between QuickBooks and Quicken is that QuickBooks focuses on accounting for small businesses, while Quicken focuses on the finances of individuals. Although Quicken does have a version of its software for both rental property owners and small businesses, it is not double-entry accounting software and thus is not as advanced as QuickBooks. Quicken and QuickBooks Online allow you to access your data on the go with their mobile apps, but Quicken’s mobile app is limited in functionality as compared to QuickBooks.

What are the Benefits of Accounting Software?

Now when you view the P&L you’ll see an expense in the business section and corresponding income in the personal section. If you don’t need or want to record the amounts you pay yourself, you can always do a regular transfer. A major benefit to analyzing a company’s profitability through QBO is the addition of the “locations” feature. In addition to a “class” system, the location system provides even more granularity to determine overall profitability.

Quickbooks Desktop is being phased out by Intuit slowly and encouraging users to import their files and move to Quickbooks online. As we can see in the table below, Quickbooks Online Ecosystem has outpaced the Desktop ecosystem which has led to Intuit investing more and more in the online version. Quickbooks was inspired by Quicken, a personal accounting package. QuickBooks was intended to offer small business owners the flexibility of an easy-to-use software package and the structure and compliance that are needed to manage a profitable business. QuickBooks provides users with a variety of budgeting tools, enabling them to create and track their budgets more effectively.

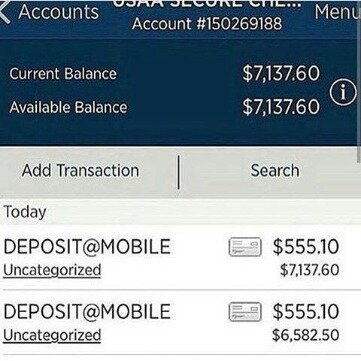

Using the QuickBooks software to manage the cash flow and entering your financial data on an orderly basis for all your accounts can really be beneficial to know the state of cash flow from your accounts. You can enter the transactions for the items like recurring payments, loans, or any kind of deposits that you do on monthly basis via QuickBooks. The main task of cash-flow management is reconciliation that you must do once in two weeks or every week. You have to think like that you are managing your books on the personal finances. The activity named set-it-and-forget-it is used for all the transactions that happen on a regular basis.

Easy Process

Quickbooks has helped me keep track of my personal finances, manage expenses and taxes, and stay organized with invoicing. Buy QuickBooks as a desktop program or as part of an online program. Starting at $15 per month, QuickBooks Online offers features such as a more robust mobile app, real-time collaboration and access on the go. Its Desktop version starts at $349.99 per year, and you can get unlimited expert access and support from QuickBooks, pay 1099 contractors and track inventory. QuickBooks Online makes it easy to upgrade plans as your business grows. Simply change your subscription from Simple Start to Essentials, for example, and you instantly add time tracking and bill pay functionality to your account.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

You may record both past and future transactions, which means you can more easily anticipate you’re spending for the coming months if you know payments are due shortly. Do not worry about generating invoices when running a business from your home as Quickbooks home accounting software helps you create professional-looking invoices tailored for your brand within no time. Besides, it helps you set up recurring invoices for regular customers a well as automatically adds billable hours to the invoices both for clients and employees. Apart from this, Quickbooks automatically matches your payments with the invoices in order to balance your books of accounts. There’s one small downside to this method, which is that transfers between your business and personal accounts won’t show up on the Profit & Loss report by default. Consider the situation where you pay yourself a monthly “salary” by transferring $10k from your business checking to your personal checking.

Tips for Using QuickBooks To Manage Personal Finances

Tina’s work has https://bookkeeping-reviews.com/eared in a variety of local and national media outlets. You can rest assured that we will work closely with you to create actionable business plans and accurate financial reporting. We offer our toolkit of financial intelligence that will be your greatest asset for business growth. The combination of automating your bills and income along with daily reconciliations is really powerful for your family finances. You will become more involved with your finances so you are paying closer attention and caring more.

In order to run your house properly, it is very important to prepare a budget that includes an estimated amount of various home expenses like groceries, utilities, home rentals, taxes, etc. Besides this, you can even upload your receipts and match them to existing expenses or create new expense categories. Furthermore, you can classify your receipts into various tax categories so that you do not have to undergo stress while filing tax returns. Bookkeeping system that allows you to record any payment or receipt with regards to any income, expenditure, asset, or liability.

Cost

Investopedia does not include all offers available in the marketplace. We independently research, test, review, and recommend the best products—learn more about our process. Our team here at Owl has been built by selecting talent that has extensive in-the-field experience in multiple industries. If you run monthly and annual comparisons, it will make it very easy to see any areas for concern in a snapshot view. Essentially, you need to reconcile any account that has a statement with a beginning and ending balance, and a start and end date. One of the most effective savings tools is the automation of saving deposits.

Xero is our top pick and best alternative to QuickBooks because it offers similar functionality to QuickBooks at a lesser cost and unlimited users. So if the price or restricted users are your biggest issues with QuickBooks, Xero is a good option. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Web Connect functionality automatically enters transactions and updates balances when you log in to Online Banking and initiate a download of a certain transaction period.

Here’s why these QuickBooks Online features prepare you for tax season – New York Post

Here’s why these QuickBooks Online features prepare you for tax season.

Posted: Fri, 10 Mar 2023 16:18:00 GMT [source]

I haven’t been able to download my forever freedom international bank data as a QB file. It knows it’s a personal account and only downloads as a Quicken file. So, I have both but would like to use QB for my personal finances. I just can’t seem to find a way to download the files as a QB file. Currently, QuickBooks is offering two different specials; you can either try it free for 30 days or sign up and get a 50% discount on your first three months. All these apps integrate seamlessly with each other and QuickBooks accounting software, thus building a well-rounded accounting and payments ecosystem for your small and mid-sized business.

Finally, FreshBooks has a user-friendly layout that many non-technical users would find straightforward to manage in many cases. This software is specifically tailored to the needs of freelancers, independent contractors, gig-economy workers, and other self-employed individuals. It provides useful tools for bookkeeping, time tracking, preparing for quarterly taxes, invoicing clients, collecting sales tax, tracking profit and loss, preparing a tax summary, and more. Performing routine reconciliations is a great way to ensure the accuracy of your accounts and is a major safeguard against theft and fraud.