Forex Trading

Gann Fan Drawing Tools

Contents:

When speed and accuracy count, this is a signature game-changer. There are literally dozens, if not hundreds of ways to trade the forex market. We have discussed some of these technical trading methods in our articles. The IPO of Millennium Group International Holdings Limited will take place on the NASDAQ exchange on 29 March. The company manufactures and sells packaging materials in the Chinese market.

The trader selects the starting point and the lines extend out into the future. To add the Gann Fans drawing to chart, select it from the Active Tool menu. Specify begin and end points of the trendline; other default ratio lines will be added automatically. Note that you can modify the ratio for any line using the drawing properties. William Delbert Gann considered that markets move in accordance with the laws of geometry.

Gann Theory Explained

It also records signature gradients to track geometric repeatabilities. It also offers one-click speed https://traderoom.info/s for quick parameter changes of fan properties. And it templates line draws across multiple timeframes.

Plans for Race Week’s Fan Fest told News journalpatriot.com – Wilkes Journal Patriot

Plans for Race Week’s Fan Fest told News journalpatriot.com.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. For a Gann Fan, two reference points define the middle line of a seven-line “fan” of time relative to price.

Trading with the Gann Fan

William Gann is one of the most famous traders of the beginning of the XX century. He was born on June 6, 1878 in the village of Lafkin in a poor large family. At the age of 13, William Gunn earned on trains selling newspapers and cigarettes. He heard a lot in conversations about investments and forecasts of cotton prices.

Although methods of applying Gann angles on the chart are still old but to use this method with a confluence to increase the winning probability will be discussed in this article. When analyzing multiple charts with a Gann fan, it may be apparent that the tool is not always useful. Of course, the same reasoning applies to short sales by reversing the terms. To the extent that operational discipline is applied, short-selling transactions present the same risks as taking long positions. Very often, the daily price will be too far from the breakout price, and the sum to be lost in case of failure will be too great; you will then renounce the project of your own accord. Don’t go against the market trend and trade in liquid markets.

The question about volatility is in the Gann angle line. This article will mainly talk about the problem of selecting points. The selection point of the Gann angle line is generally selected… Futures and forex accounts are not protected by the Securities Investor Protection Corporation .

FXOpen Forex Broker

I still feel awe when it all fits and I call it grace as it shows… Gann theory has been widely used in various fields of finance. To learn to apply the Gann angle line, two problems need to be solved, namely, point selection and volatility.

The fan comprises nine diagonal lines with the 45-degree angle line acting as the center line, while the other eight will be located below or above this line. W.D. Gann’s indicators and theories are mathematically based. Gann Fans, use proportions of time and price to calculate an angle. What is called Gann Fan is actually set of angles that are part of the square. In the video I’ve marked price swings using time balance concept and number 144 After marking swings I’ve put Gann Fan and set it to hit top and bottoms of the swings. Next step I duplicated Gann Fan with the same settings to show that all price swings follow some angle and angle…

Applying Gann Techniques to Forecast Currency Price Movements – Forex Training Group

As William Gunn himself said, the reasons for his success are the cyclical nature of time, history and markets. He devoted himself to a deep study of ancient astrology, ancient mathematics, geometry and astronomy. He was a religious man and a member of Masonic society. Gann wrote many books on stock trading and gained many supporters of his theory.

Gann fans should be used in conjunction with other technical indicators, price action, and other forms of analysis. The 45-degree angle line of the Gann fan should be aligned with a 45-degree angle on the chart. To find the 45-degree angle, use the degree angle tool on your charting platform. Gann believed the 45-degree angle to be most important, but the Gann fan also draws angles at 82.5, 75, 71.25, 63.75, 26.25, 18.75, 15, and 7.5 degrees.

These tools, known as Gann indicators, still have a valuable use in the markets today. Both time and price are relative in this tool, and you can predict price with respect to time and time with respect to price. For example, if the price is respecting a trendline with a 45-degree angle then after its breakout it will move on to the next angle like an angle of 35 degrees. Gann Fan trading strategies primarily use the nine diagonal lines as 1. The tool, drawn from a trend reversal point, consists of nine diagonal lines called Gann angles.

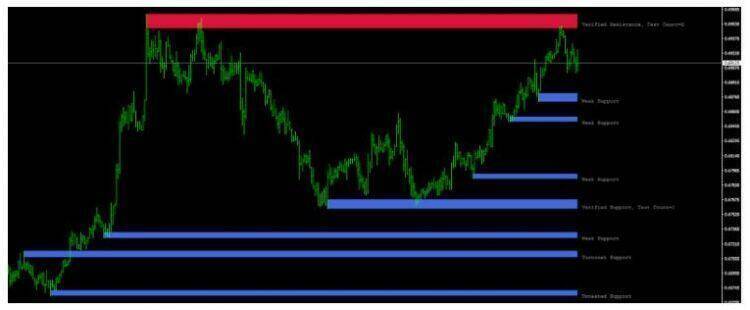

The Gann Fan is a technical analysis tool created by WD Gann. The tool is comprised of 9 diagonal lines designed to show different support and resistance levels on a chart. Please note that the chart needs to be scaled properly to ensure the market has a square relationship.

A Week in the Market: All Eyes on Prices (17-21 April)

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should consider whether you can afford to take the high risk of losing your money. Similarly, angles like the 2×1 line, where the price moves two units for every single time unit, will result in a line flatter than 45 degrees.

Wilfred Co-Creator Jason Gann on His Cannabis Brand, Delta-8, and Mental Health – High Times

Wilfred Co-Creator Jason Gann on His Cannabis Brand, Delta-8, and Mental Health.

Posted: Fri, 07 Apr 2023 07:00:00 GMT [source]

The first reference point is the one from which the fan extends. The second reference point, drawn to the right of the first, determines the rate of equivalence between time and price. The angles of the fan, relative to an assumed horizontal line and middle line’s angle, are shown in the table value. Trading stocks, options, futures and forex involves speculation, and the risk of loss can be substantial. Clients must consider all relevant risk factors, including their own personal financial situation, before trading.

When drawing a Gann Fan over an uptrend, the fan should be drawn upward to the right from a market low, and in a downtrend, the fan should be drawn down to the right from a market high. For more information, see Format the Settings of a Gann Fan. Breakouts above or below this balance line indicate possible trend changes. Wait until the price breaks above the 2/1 Gunn angle before opening a buy deal. This step is very important because the reversal of the previous trend is confirmed only after the breakdown of the Gann angle 2/1.

- Like after movement of GOLD from $1100 to $1200 within two days then it will retrace to $1150 within the next two days.

- Gann fans don’t require a formula although they do require an understanding of slope degrees.

- As we can see from the image below, graphically, the Fan of Gann consists of a series of lines that open “fan” starting from a point .

- I’ll provide a simple Gann fan trading strategy also show you how to use the Gann fan indicator using Tradingview.

- Consequently, Gann fans can help traders time their entry and exit points.

Also, read my personal trading plan reviewed by Kim Krompass. A trend is the general price direction of a market or asset. Determining the trend direction is important for maximizing the potential success of a trade. Think of a piece of graph paper with lots of little squares or grids on it.

The 45 gann fan line represents 1 unit of price movement with 1 unit of time. In this selection, there is a showing of the use of angles to measure the passage of time and price. In the first chart, the 30 minute chart, there is 40 units of time, and 40 units of price. The angle that is correspondent with this ratio spans to the end of the enclosed trend. In the next chart, the four minute chart, there is 40 units… The next step is to select any major swing high or swing lows on the chart from where you draw the Gann fan angles.

We have special Gann fan angles and more specifically Gann came up with 9 different angles . A trendline, on the other hand, does have some predictive value. However, because of the constant adjustments that usually take place, it’s unreliable for making long-term forecasts. Gann fans don’t require a formula although they do require an understanding of slope degrees. Right-clickon the chart to display the context menu, and selectGann Fan.

Sustained moves above the 1×1 line show a bullish trend, while moves below are considered bearish. The Gann Fan is a series of trend lines based on price and time that can be used to identify potential key levels of support and resistance. It works by drawing a set of lines at different angles to represent trend lines and price movements. This trading strategy is a complex support and resistance trading strategy. Unlike the traditional horizontal support and resistance levels, the Gann fan angles are mathematically calculated based on the price, time and the price range of the market.

This point has been identified as the start of an up or down trend. Now, let’s move forward to the most important part of this article. These are the trading rules of the best Gann fan trading strategy. The lines continually spread out over time, making the distance between the lines extremely large. This is not to say that a Gann angle always predicts where the market will be. Rather, the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend.

- Very often, the daily price will be too far from the breakout price, and the sum to be lost in case of failure will be too great; you will then renounce the project of your own accord.

- Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature.

- In the above example the coordinates of the Gann box are listed.

- Determining the trend direction is important for maximizing the potential success of a trade.

- One of the main reasons that Gann levels outperform horizontal support and resistance levels is because financial markets are constantly moving.

Once you have chosen your swing low point, simply utilize the trend Angle tool and draw a perfect 45-degree angle. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. A Fibonacci fan is a charting technique using trendlines keyed to Fibonacci retracement levels to identify key levels of support and resistance.

They indicate a time to price relationship that may be relatively fast or relatively slow, depending on the size of the Gann angle. In summary, Gann indicators, particularly Gann angles and Gann fans, may help us predict future price movements with a high degree of accuracy. However, their subjective nature can make them tricky to apply consistently, and they are better suited to more experienced traders. Gann fans offer an easy way for traders to plot these angles. The fans consist of nine diagonal lines that use the price-time relationships described earlier, as seen in the diagram.